So You’re Going to Buy a House

Money is kinda important in the house-buying progress. You might be lucky enough to be able to buy a house with cash, but most people need a mortgage to do so.

Please note that I am in no way qualified to give financial advice, this is all based on my own understanding of the mortgage process and my own experiences of same. If you follow my advice and end up in debtor’s prison or indentured servitude, that is completely your own fault – absorb this information at your own risk!

The important factors affecting a mortgage are LTV, down payment, interest rates, and the term of the mortgage.

I’ve put together a spreadsheet that calculates all the relevant factors. You can access it to get your own copy HERE. I’ve included the values from our example below as default, but you can play with the numbers to make it relevant to you.

How Much Will the Bank Give Me?

Your bank will look at your salary to determine how much to give you. The general formula is 3.5 x total salary.

The linked mortgage spreadsheet has a calculator for maximum mortgage values if you want to play around with some numbers.

What Does the Bank Need From Me?

Apart from the down-payment, the bank will need some proof that you can make the repayments. This varies from bank to bank, so I’m going to list what we were asked for by the banks that we went to when shopping around. If you have the majority of these in order, you should be fine. Just make sure to keep copies of your own – we had a few issues with the bank losing parts of paperwork, even when everything was included in a single zipped folder…

- Bank-specific application form

- Bank-specific salary certificate showing what you get paid and that you’re in permanent employment

- The last 2 most recent payslips for each of you

- A copy of your most recent P60

- 6 Months current account statements (if any of the people involved isn’t an account holder with the bank in question)

- An up to date statement of all savings/loans/credit cards held with any Financial Institution other than the bank

- Copy of passport and driving license

- Proof of current address (utility bill)

Down Payment & LTV

A bank will expect a certain portion of the cost of the house to come out of your own pocket. This is to reduce their outlay but also to prove that you can save reliably. They tend to look down on down payments that consist mostly of lump sum gifts or inheritance, so beware there. Most banks will only look for 6 months of saving records though, so you may be able to disguise that sort of cash infusion, but not if simple division of the time you’ve been of working age by the amount you regularly save doesn’t add up!

My mortgage spreadsheet has a calculator to show you the maximum house value you can afford with your total savings.

Interest Rates

Generally, the smaller the percentage of the loan compared to the value of the house (%LTV), the more favourable the interest rates. First-time buyers in Ireland are eligible for a 90% LTV loan, but the interest rates on that don’t tend to be as nice! You can get a fixed or variable rate mortgage.

Fixed-rate mortgages have a fixed mortgage rate over a certain timeframe (usually for a few years). This is good if the market is unstable or if they offer you a nice rate, but the downside is that you generally can’t pay it off early without incurring a penalty to make up for the bank’s lost earnings.

Variable rates…vary! They could go down or up. Self-explanatory! The nice thing about a variable mortgage is that you can pay the whole thing off at the drop of a hat should you wish to.

Mortgage Term

The term of the mortgage is another variable – the advice we got was “Ask for the longest term you can. You can always pay off the mortgage early if circumstances allow, but asking for an extension from the bank is not going to go well.”

Typically, the mortgage terms range from 15 years to 35 years, but they’re not going to give a 55 year old a 35 year mortgage due to increasing risk of death and the inevitable loss of earnings on retirement.

Loan Repayment

This is where I’m going to get all technical. I’m going to actually include an Excel formula to get us started. If you don’t want to get bogged down in the nitty-gritty, just plug some numbers into the mortgage calculator spreadsheet, but if you’re curious – read on!

This the same type of formula used to calculate annuities, but with a minus in front of it.

= -PMT(Interest Rate / Payments per Year, Total Number of Payments, Starting Loan Amount)

So, for a 35 year mortgage of €200,000 (that’s €222,222 house value if we’re doing 90% LTV!) at a rate of 3%, the formula would look like the following for a given month’s repayment.

= -PMT(3% / 12, (35 * 12), 200000) (which = €769.70)

Now, you might think that the following month’s repayment knocks the previous payment off the Loan Amount variable…you’d be wrong. This is where mortgage calculations become like witchcraft. Every month’s repayment stays the same (as long as the interest rate remains the same). What actually happens is that the remaining Loan Amount (i.e. the amount still to be paid off to the bank) gets paid off after interest has been calculated. So what happens is the following:

Interest Payable = Remaining Loan Amount x (Annual Interest Rate / 12) Amount paid off loan = Monthly Repayment - Interest Payable

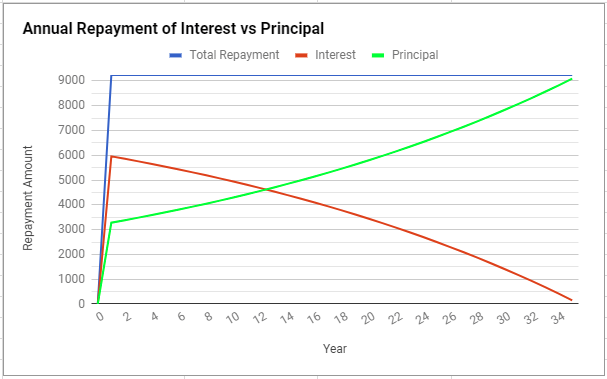

This means that the monthly repayments start off as mostly interest and the remaining loan balance won’t change much for a while! I’ll provide context here by inserting the numbers from our example above.

Month 1 Interest Payable = 200000 x (0.03 / 12) = 500 Amount paid off loan = 769.70 - 500 = 269.70 Loan Amount Remaining = 199730.30 Month 2 Interest Payable = 199730.30 x (0.03 / 12) = 499.30 Amount paid off loan = 769.70 - 499.30 = 270.40 Loan Amount Remaining = 199459.90 ... Month 419 (Year 35!) Interest Payable = 1534 x (0.03 / 12) = 5.74 Amount paid off loan = 769.70 - 5.74 = 763.96 Loan Amount Remaining = 768 Month 420 (Year 35!) Interest Payable = 768 x (0.03 / 12) = 1.92 Amount paid off loan = 769.70 - 1.92 = 768 Loan Amount Remaining = 0

And so the balance gradually shifts over time, but, as you can see, most of the early years of the mortgage will be spent just paying interest. Which brings me on to…

Early Repayment

From the example above, it should be clear that the loan repayment value calculated by the -PMT formula gives the bank a lot of money. The remedy for this is to make early repayments. As I specified above, however, paying off a fixed-rate mortgage early will incur a penalty payment, so be careful that you understand your mortgage’s terms before going down this road!

An extra repayment of €5000 per year reduces our example mortgage from 35 years to 19 and reduces the total interest paid from €123,274 to €62,025. That’s a lot of money saved. Consider this option! Playing with the repayment value in the spreadsheet is a bit of an eye opener, I suggest you give it a try!